PropNex Picks

|May 13,2025Almost Same Price, Which Region Would You Go for?

Share this article:

Everyone loves a good deal, whether it's online shopping, deciding what to eat, or buying property. We just can't help it, our brains are wired to chase value. Like when you're on Shopee or Taobao, and you're just a few dollars away from getting free shipping. So what do you do? You add a few more things to your cart. Might as well, right?

Or when you're at the drive-thru trying to get some fries. The medium costs $4.70, but the large is $4.90. Only 20 cents more. Of course you're going to upsize!

Now, what if the same logic applies to real estate?

For the longest time, buyers have leaned towards homes in the RCR or OCR, because more space + lower prices = better value. But something interesting is happening in the market. The numbers are shifting, and what used to be a clear difference might not be so clear anymore.

Let's take a closer look at how the price dynamics between the regions have changed, what that means for you, and if you should consider CCR for your next purchase.

For years, owning a property in the CCR - think Orchard, Marina Bay, Tanglin, Newton - has been considered a status symbol. It's the heart of the city, the areas closest to top offices, luxury malls, and the CBD. If you worked in finance, law, or Multinational Corporations (MNCs), odds are your office was in the CCR. Naturally, living nearby was a premium, and home prices reflected that exclusivity.

But, some things have changed.

Today, the government has decentralised commercial hubs, spreading job opportunities across the island to ease congestion in the city. Places like Jurong, Woodlands, and Tampines have popped up with different hubs. That means you no longer need to live in the city centre to be near work. Not to mention the whole work-from-home and hybrid work setting that are quite popular these days. These shifts have boosted the appeal of homes in RCR and OCR.

What's interesting though, is that while RCR and OCR prices have surged, CCR prices have remained relatively stable. So now, the price difference between the regions has narrowed quite a bit. But one thing that has not changed is the status and prestige of owning a CCR property...

Source: PropNex Investment Suite

In 2015, the CCR-RCR gap was 27.03% and the CCR-OCR gap was 50.76%. This year, the gaps are 3.76% and 24.36% respectively. Insane right? But if you pay closer attention, you'll also notice that CCR prices have only grown by 36.8% in the past decade, which is far slower than RCR (80.4%) and OCR (110.16%). In other words, the high-end market has been slowing down as the rest of the market catches up.

In April 2023, the government decided to raise the Additional Buyer's Stamp Duty (ABSD) rate for foreigners to 60%. This cooling measure deterred many buyers because the CCR market is popular amongst foreign buyers and investors. Imagine buying a $3 million condo and then being told you have to pay an additional $1.8 million. The ABSD amount alone can get you a whole other unit.

The sharp increase in HDB resale prices also meant that more upgraders could afford homes in the OCR and even the RCR. Meanwhile, investors remain cautious about luxury CCR properties. This may also push the narrowing price gaps.

It doesn't help that CCR has a smaller buyer pool to begin with. Most Singaporean buyers prefer RCR or OCR since they're more affordable and practical for daily living. CCR was always more niche, mostly attracting investors or ultra-rich buyers. So, with foreigners pulling back and fewer locals buying CCR homes, demand just took a dip.

Because of all this, developers in the CCR aren't rushing to launch new projects. Why launch when buyers aren't biting? That means even fewer sales in CCR overall. In fact, only 378 new CCR homes were sold in all of 2024, which is a new low.

So, now we're looking at a situation where you can snag a property in the city's most desirable neighbourhoods if you top up just a little bit. And logically speaking, if you're already prepared to pay close to CCR prices, you might as well get a CCR property.

You'd be minutes away from key employment hubs, many great schools, shopping malls, and eateries. Yes, one might argue that most of Singapore has great amenities and connectivity anyway. But CCR is undeniably unbeatable when it comes to convenience.

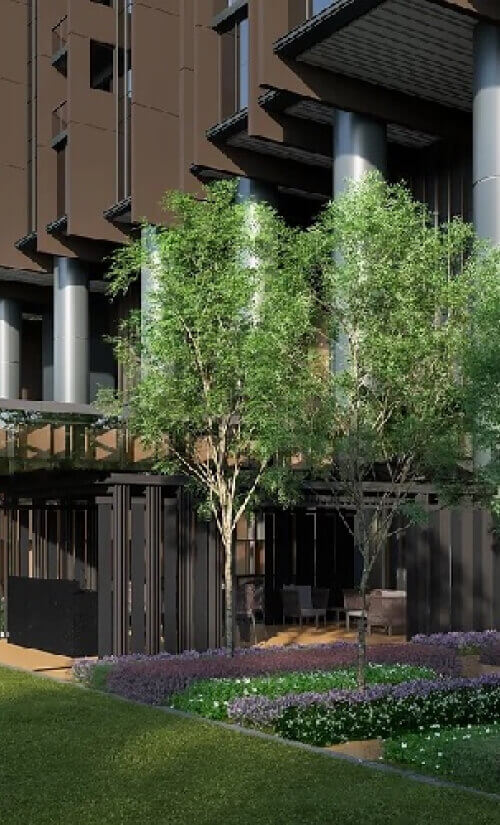

Take Aurea, a newly launched CCR project, as an example. With starting prices from $2,750 psf or just $1.92 million, it offers a surprisingly accessible entry point into the CCR market.

Source: Aurea

Now, compare that to the average new launch prices in the RCR between January 2024 and April 2025: an average of $2,660 psf and an average transaction price of $2.38 million.

Source: PropNex Investment Suite

If you ask me, I'd rather get the CCR. It's not just about the bragging rights. If you look at the rental market, CCR still performs the best, averaging at $6,400 per month from Q1 2021 to Q1 2025. Meanwhile, RCR and OCR averaged at $4,260 and $3,560 per month in the same period.

Source: PropNex Investment Suite

CCR rent is also more resilient against market oversupply. In 2017, when there was a surge of properties, rents dropped everywhere, but CCR took the smallest hit. According to URA, rental income in the CCR only fell by about 3.8%, compared to around 5% to 5.6% in the RCR and OCR. Again, it's about the location. You can have ten new condos in Bishan, but Orchard Road is still Orchard Road. So even though the rental yield is low compared to the high capital, you won't have to worry so much.

Tl;dr, it's more prestigious and the rental market is better.

Now, let's not ignore the fact that RCR and OCR have their own appeal. RCR and OCR prices have been on the rise over the past few years, largely due to the redevelopment of older estates, improving infrastructure, and stronger transport connectivity, especially with new MRT lines.

Even though RCR and OCR properties see capital appreciation, there's a limit to how much these locations can "level up." End of the day, CCR will always be the heart of the city. And its scarcity factor (very little land left for new development) will continue to push property values upwards.

It's like choosing between a good car and a luxury sports car. Both will get you from point A to point B, but one's going to give you way more prestige and long-term value.

So, if you've been thinking about buying a home, now might be the perfect time to consider the CCR, especially when the price gap between the regions are this close. Aside from the unmatched location, CCR properties provide greater long-term stability and value preservation. And with the current ABSD rules, you'll have less competition from foreign investors.

But, this window won't stay open forever. New launches are already selling fast and as the market adjusts, who knows how soon the price gap will widen again. If you've been waiting for the right moment, this could be it. If you're still unsure, don't worry, you don't have to do this alone. Join us at Singapore Property Xpo 2025 to learn how to make smart property moves in these uncertain times.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.